Who's it for

This workflow is perfect for individuals who want to maintain detailed financial records without the overhead of complex budgeting apps. If you prefer natural language over data entry forms and want an AI assistant to handle the bookkeeping, this template is for you. It's especially useful for:

- People who want to track cash and online transactions separately

- Anyone who lends money to friends/family and needs debt tracking

- Users comfortable with Slack as their primary interface

- Those who prefer conversational interactions over manual spreadsheet updates

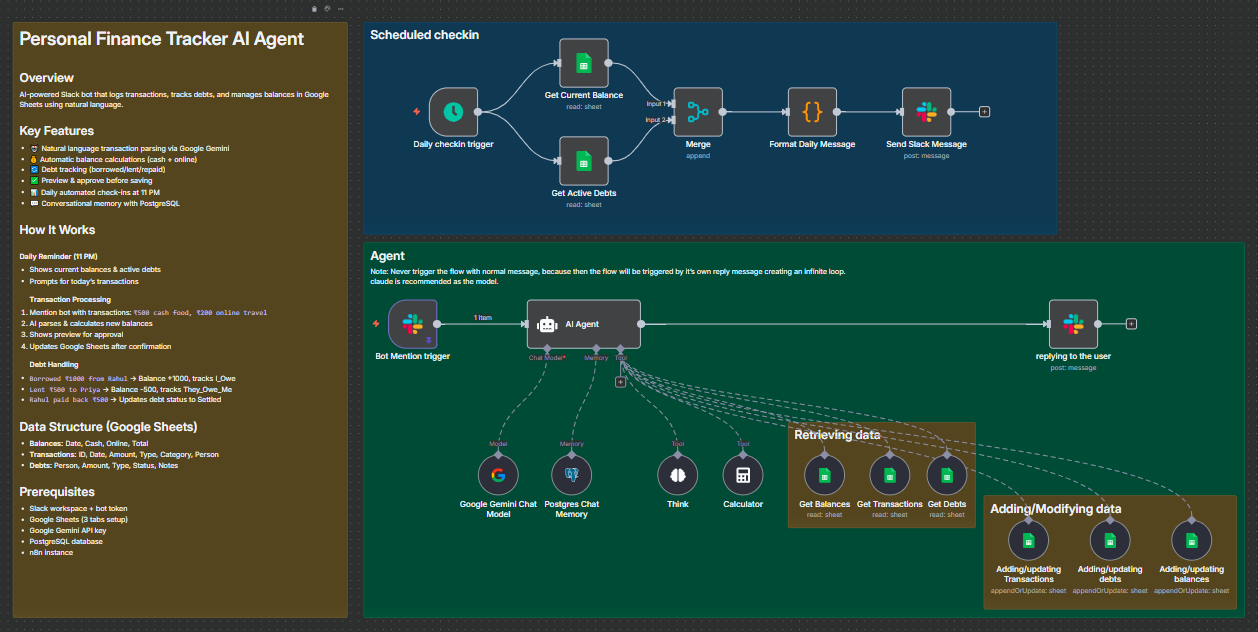

What it does

This AI-powered finance tracker transforms your Slack workspace into a personal finance command center. Simply mention your bot with transactions in plain English (e.g., "₹500 cash food, borrowed ₹1000 from John"), and the AI agent will:

- Parse transactions using natural language understanding via Google Gemini

- Calculate balance changes for cash and online accounts

- Show a preview of changes before saving anything

- Update Google Sheets only after you approve

- Track debts (who owes you, who you owe, repayments)

- Send daily reminders at 11 PM with current balances and active debts

The workflow maintains conversational context using PostgreSQL memory, so you can say things like "yesterday's transactions" or "that payment to Sarah" and it understands the context.

How it works

Scheduled Daily Check-in (11 PM)

- Fetches current balances from Google Sheets

- Retrieves all active debts

- Formats and sends a Slack message with balance summary

- Prompts you to share the day's transactions

AI Agent Transaction Processing

When you mention the bot in Slack:

Phase 1: Parse & Analyze

- Extracts amount, payment type (cash/online), category (food, travel, etc.)

- Identifies transaction type (expense, income, borrowed, lent, repaid)

- Stores conversation context in PostgreSQL memory

Phase 2: Calculate & Preview

- Reads current balances from Google Sheets

- Calculates new balances based on transactions

- Shows formatted preview with projected changes

- Waits for your approval ("yes"/"no")

Phase 3: Update Database (only after approval)

- Logs transactions with unique IDs and timestamps

- Updates debt records with person names and status

- Recalculates and stores new balances

- Handles debt lifecycle (Active → Settled)

Phase 4: Confirmation

- Sends success message with updated balances

- Shows active debts summary

- Includes logging timestamp

Requirements

Essential Services:

- n8n instance (self-hosted or cloud)

- Slack workspace with admin access

- Google account

- Google Gemini API key

- PostgreSQL database

Recommended:

- Claude AI model (mentioned in workflow notes as better alternative to Gemini)

How to set up

1. Google Sheets Setup

Create a new Google Sheet with three tabs named exactly:

Balances Tab:

| Date | Cash_Balance | Online_Balance | Total_Balance |

|---|

Transactions Tab:

| Transaction_ID | Date | Time | Amount | Payment_Type | Category | Transaction_Type | Person_Name | Description | Added_At |

|---|

Debts Tab:

| Person_Name | Amount | Type | Date_created | Status | Notes |

|---|

Add header rows and one initial balance row in the Balances tab with today's date and starting amounts.

2. Slack App Setup

- Go to api.slack.com/apps and create a new app

- Under OAuth & Permissions, add these Bot Token Scopes:

app_mentions:readchat:writechannels:read

- Install the app to your workspace

- Copy the Bot User OAuth Token

- Create a dedicated channel (e.g.,

#personal-finance-tracker) - Invite your bot to the channel

3. Google Gemini API

- Visit ai.google.dev

- Create an API key

- Save it for n8n credentials setup

4. PostgreSQL Database

Set up a PostgreSQL database (you can use Supabase free tier):

- Create a new project

- Note down connection details (host, port, database name, user, password)

- The workflow will auto-create the required table

5. n8n Workflow Configuration

Import the workflow and configure:

A. Credentials

- Google Sheets OAuth2: Connect your Google account

- Slack API: Add your Bot User OAuth Token

- Google Gemini API: Add your API key

- PostgreSQL: Add database connection details

B. Update Node Parameters

- All Google Sheets nodes: Select your finance spreadsheet

- Slack nodes: Select your finance channel

- Schedule Trigger: Adjust time if you prefer a different check-in hour (default: 11 PM)

- Postgres Chat Memory:

- Change

sessionKeyto something unique (e.g.,finance_tracker_your_name) - Keep

tableNameasn8n_chat_history_financeor rename consistently

- Change

C. Slack Trigger Setup

- Activate the "Bot Mention trigger" node

- Copy the webhook URL from n8n

- In Slack App settings, go to Event Subscriptions

- Enable events and paste the webhook URL

- Subscribe to bot event:

app_mention - Save changes

6. Test the Workflow

- Activate both workflow branches (scheduled and agent)

- In your Slack channel, mention the bot:

@YourBot ₹100 cash snacks - Bot should respond with a preview

- Reply "yes" to approve

- Verify Google Sheets are updated

How to customize

Change Transaction Categories

Edit the AI Agent's system message to add/remove categories. Current categories:

- travel, food, entertainment, utilities, shopping, health, education, other

Modify Daily Check-in Time

Change the Schedule Trigger's triggerAtHour value (0-23 in 24-hour format).

Add Currency Support

Replace ₹ with your currency symbol in:

- Format Daily Message code node

- AI Agent system prompt examples

Switch AI Models

The workflow uses Google Gemini, but notes recommend Claude. To switch:

- Replace "Google Gemini Chat Model" node

- Add Claude credentials

- Connect to AI Agent node

Customize Debt Types

Modify AI Agent's system prompt to change debt handling logic:

- Currently:

I_OweandThey_Owe_Me - You can add more types or change naming

Add More Payment Methods

Current: cash, online

To add more (e.g., credit card):

- Update AI Agent prompt

- Modify Balances sheet structure

- Update balance calculation logic

Change Approval Keywords

Edit AI Agent's Phase 2 approval logic to recognize different approval phrases.

Add Spending Analytics

Extend the daily check-in to calculate:

- Weekly/monthly spending summaries

- Category-wise breakdowns

- Use additional Code nodes to process transaction history

Important Notes

⚠️ Never trigger with normal messages - Only use app mentions (@botname) to avoid infinite loops where the bot replies to its own messages.

💡 Context Awareness - The bot remembers conversation history, so you can reference "yesterday", "last week", or previous transactions naturally.

🔒 Data Privacy - All your financial data stays in your Google Sheets and PostgreSQL database. The AI only processes transaction text temporarily.

📊 Backup Regularly - Export your Google Sheets periodically as backup.

Pro Tips:

- Start with small test transactions to ensure everything works

- Use consistent person names for debt tracking

- The bot understands various formats: "₹500 cash food" = "paid 500 rupees in cash for food"

- You can batch transactions in one message: "₹100 travel, ₹200 food, ₹50 snacks"